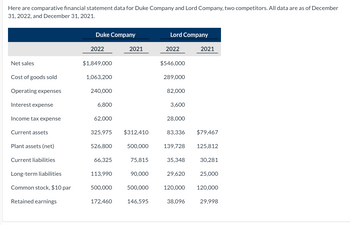

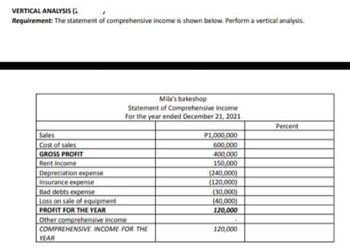

For example, a company could conduct vertical analysis on its revenue assertion to determine the percentage of income spent on varied expenses, such as marketing or analysis and development. This info can guide strategic choices, such as finances allocation and price management. Additionally, investors may use vertical evaluation to check the financial performance of various firms inside the similar industry. Vertical Analysis is a method of monetary statement evaluation during which each line item on a financial statement is listed as a proportion of another item. For the earnings assertion, this base is usually total gross sales or revenues; for the stability sheet, the bottom is often whole assets. This method normalizes the monetary statements, removing the effect of measurement variations, and permits for significant comparisons between firms of various scales or durations throughout the same company.

Decoding Dollars: Your Newbie’s Compass To Corporate Financial Health

- You can also use Wisesheets to get the money flow statement data immediately in your spreadsheet.

- Vertical Analysis using the Steadiness Sheet helps in understanding the proportion of each asset, liability, and equity merchandise in firms.

- According to a report by Deloitte India, 85% of enormous firms employ vertical analysis of their monetary reviews.

- This method is especially priceless in assessing the proportion of bills to revenues, enabling analysts to evaluate operational effectivity and profitability.

- On the balance sheet, vertical analysis shows the financing construction by way of percentages of assets.

To carry out a vertical evaluation of an organization’s income assertion, you must divide each merchandise by the entire income or internet sales. This provides you with the proportion of that particular merchandise as it relates to the whole. Armed with the data and understanding gained from this information, you presumably can confidently apply vertical evaluation in your monetary evaluation endeavors. Remember to choose on applicable base figures, keep consistency, and think about industry-specific elements to enhance the accuracy and relevance of your evaluation.

While horizontal analysis stays priceless for assessing changes over time, vertical evaluation presents unique perspectives and granularity in monetary evaluation. By analyzing these ratios utilizing vertical evaluation, you can evaluate a company’s monetary place, leverage, and liquidity. The cash circulate assertion tracks the inflows and outflows of cash in an organization during a given period. It categorizes money flows into working actions, investing actions, and financing actions.

Vertical analysis focuses on percentages within a single statement, while horizontal evaluation compares the same line merchandise throughout different intervals. It takes advanced numbers and turns them into a clear picture of a company’s financial health, efficiency, and future potential. By comparing your expense percentages (like lease or salaries) to industry averages, you’ll be able to see when you’re spending effectively. In vertical evaluation, each line merchandise on a financial statement is expressed as a percentage of a chosen base figure from that statement. For instance, comparing your price percentages with these of a growing competitor can reveal should you’re spending an extreme quantity of in certain areas or not enough in others.

Let’s think about that Firm Y has a price of merchandise offered of $100,000 while having a gross sales amount of $700,000. The term vertical evaluation came about when a downward straight evaluation was carried out by on the lookout for info in common-sized financial paperwork. Specifically, percentages from a vertical analysis may not always correspond to percentages of change. For every line item, we’ll divide the quantity by the corresponding period’s revenue to reach https://www.simple-accounting.org/ at our contribution percentages.

Small Business Bookkeeping Tips

Additional, when working with massive information units, we recommend cleaning up the information to enhance the general visible illustration of the analysis. Regardless of the location, the extra important factor is to ensure the analysis clearly reveals which period it’s reflecting.

By analyzing these profitability ratios using vertical evaluation, you’ll find a way to gauge a company’s financial performance and examine it to industry benchmarks or earlier durations. Vertical evaluation, also recognized as common-size evaluation, is a technique used to assess the relative proportions of various line objects inside a financial statement. This allows for significant comparisons and identification of developments over time or across companies. The steadiness sheet supplies a snapshot of a company’s financial place at a particular time limit.

From deciding on the base figure you’ll use to calculating and decoding the results, every step is crucial in guaranteeing the accuracy and reliability of your analysis. Diving into the monetary intricacies of a enterprise typically seems like venturing via a fancy net of numbers, ratios, and terminology, which extra typically muddle than make clear. Enterprise house owners and monetary consultants grapple with the problem of deciphering these figures for strategic course.

It is also useful to check your findings with trade averages or opponents to get an thought of how well the corporate performs relative to its friends. For instance, should you discover that the corporate’s value of goods sold is greater than the trade average, this could be an indication that they do not appear to be managing their expenses as effectively as other companies. You can do the same for the other items on the income statement to get a complete view of the corporate’s earnings and bills.

Vertical Analysis of the Revenue Statement (also generally identified as a Common-Size Income Statement) helps you perceive the composition of a company’s bills and its net profitability in relation to its income. Vertical evaluation, also known as common-size analysis, is a monetary analysis approach used to judge the relative proportions of various line gadgets inside a financial statement. It entails expressing each line merchandise as a share of a base determine, typically taken as one hundred pc. This method allows for significant comparisons of line objects over time or throughout firms, highlighting changes within the composition and construction of economic statements. Vertical evaluation makes monetary statements comparable between corporations of various sizes by converting line gadgets into percentages of a base figure. For instance, two retail firms might have vastly totally different revenue amounts, however expressing the prices of goods sold as a proportion of income reveals which has a greater cost construction.